Tips for a Smooth Refund Process

• Gather all of the relevant documentation ahead of time. Gathering all of the documentation ahead of time will ensure that you have everything you need to hand in when claiming back stamp duty. This increases your chances of making a successful claim.

• Apply within the appropriate time frame. While different deadlines can apply depending on your specific circumstances, you should apply for the refund within 12 months from the date you sold your previous property.

• Carefully review the paperwork before submitting it. You should ensure that you carefully review any and all paperwork before submitting your claim. Small mistakes or miscalculations could mean that you are not able to claim as much as you deserve.

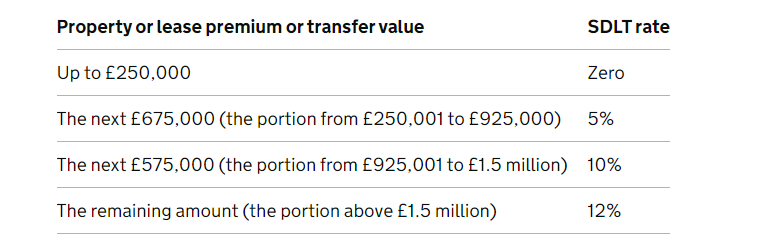

How is Stamp Duty Calculated in the UK?

The amount you will be expected to pay in Stamp Duty can vary depending upon a variety of factors, including:

• The price/value of the property you are purchasing

• Your buyer status (i.e., first-time buyer)

• The type of property you are buying

Below is an example provided by UK.Gov relating to the standard SDLT rates.

Stamp duty surcharge

Generally speaking, surcharges are applied when individuals are purchasing a second residential property or are purchasing a buy-to-let property as a private landlord.

When purchasing a second property (typically an additional dwelling), a surcharge of 3% of the standard Stamp Duty charge will apply. Non-resident buyers will also face an additional surcharge of 2%.

What is the stamp duty refund?

When applying for a Stamp Duty refund, you will be able to receive any of the surcharge costs paid. As a result, this is typically between 2-3% of the price of the overall Stamp Duty.

Why would anyone be entitled to an HMRC stamp duty refund?

There are many scenarios that could mean you are eligible for a stamp duty refund.

Second home stamp duty refund

A 3% surcharge is automatically applied when property owners buy a second property. You can claim this back if you sell your first home within three years of the purchase date.

Stamp duty land tax refund for houses with an annexe

Properties with annexes are sometimes charged a higher Stamp Duty than those without. However, this could mean that you are able to apply for a multiple dwellings relief, which is typically set at around 3%.

Shared ownership stamp duty refund for first-time buyers

First-time buyers are able to receive a significant discount on Stamp Duty and, in some cases, may not have to pay this at all (depending upon the price of the property in question). Those who purchase through shared ownership schemes may also be able to claim back some of the money spent on Stamp Duty, though this varies depending on which scheme you are involved in.

Stamp duty refund on uninhabitable buildings7

When a building is deemed uninhabitable, you may also be able to claim a Stamp Duty refund, as this is typically only applied to “dwellings.” However, appropriate evidence, such as a surveyor's report, must be provided.

SDLT refund on miscalculated properties

If the initial cost of your SDLT was miscalculated, you can also apply for a refund to rectify this, therefore reducing the amount spent over all.